food tax in massachusetts

As with cigarettes decreasing junk food consumption can reduce the burden of associated diseases. Generally food products people commonly think of as.

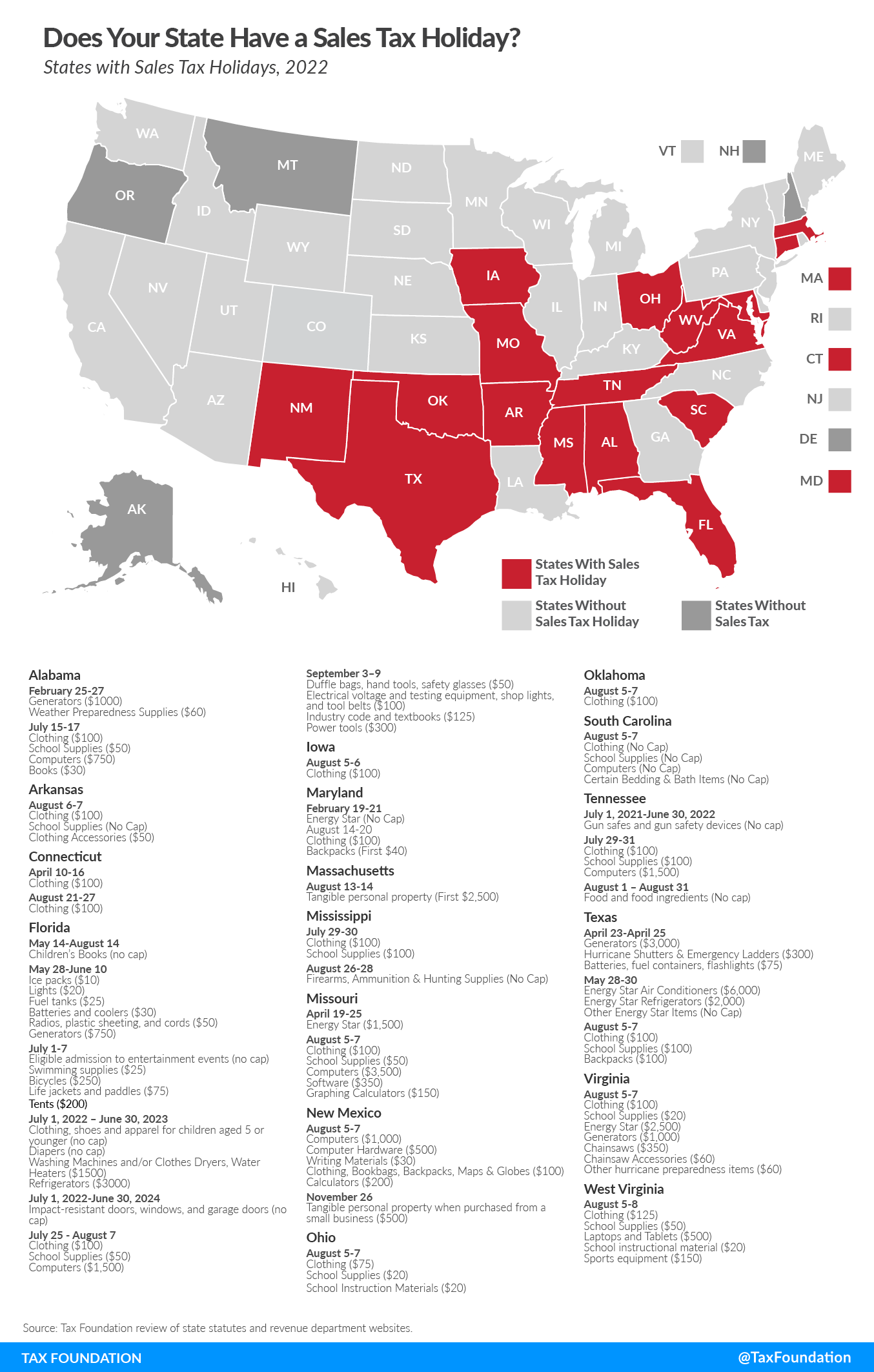

Make The Most Of The Sales Tax Holiday

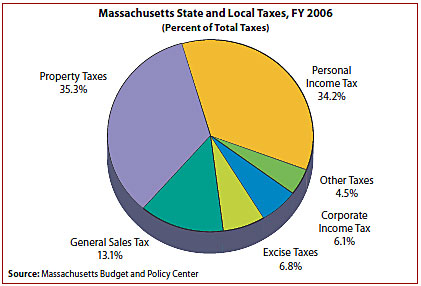

The meals tax rate is 625.

. All cities and towns in Massachusetts are authorized to adopt a local sales tax upon restaurant meals at a rate of 075 percent. Prepared Food is subject to special sales tax rates under. The state of Massachusetts is issuing checks and direct deposits to a large portion of taxpayers in an amount per NBC 10 Boston representing about 14 of what was paid in.

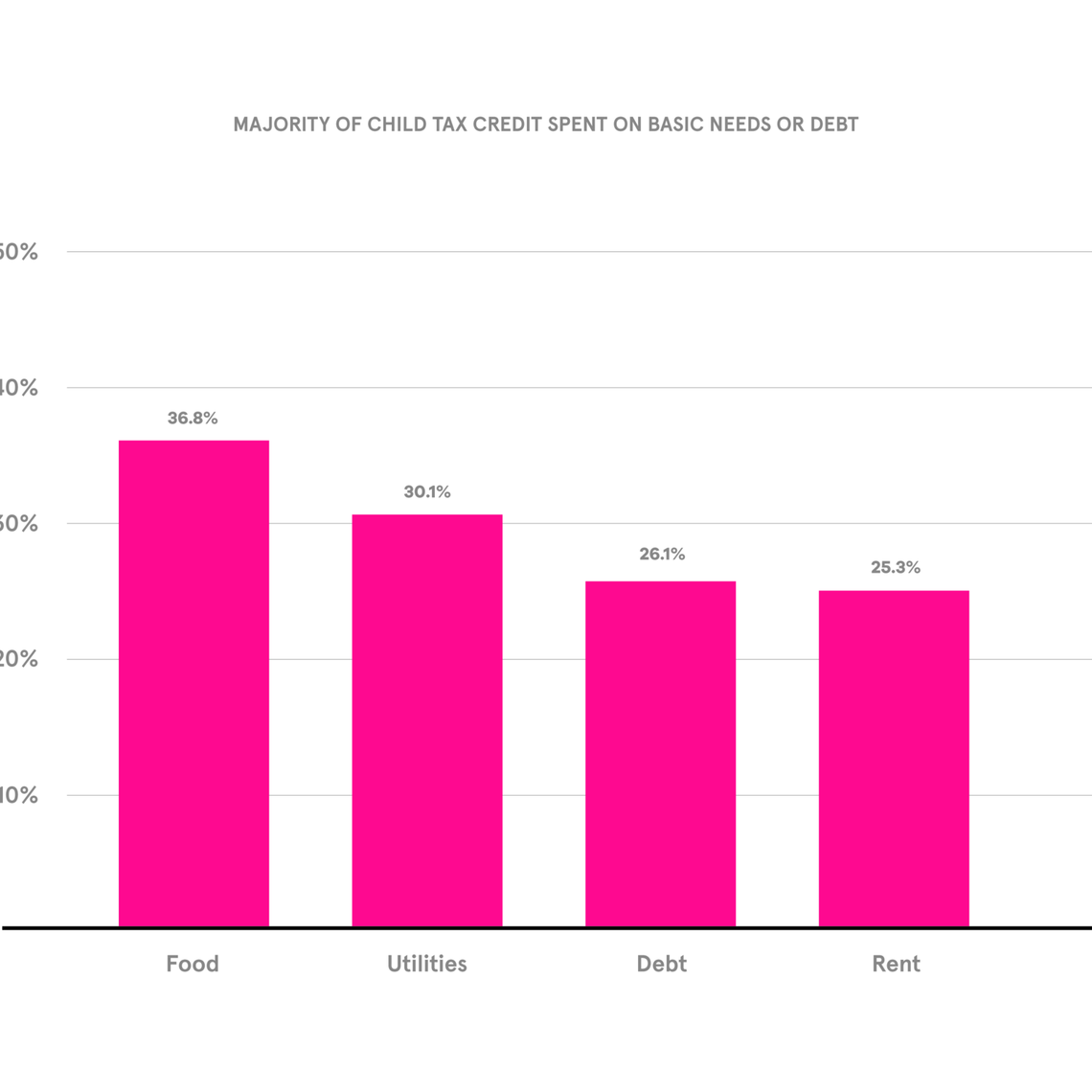

In May 2016 the Annual Town Meeting adopted Massachusetts General Law Chapter 64L section 2 a which established a local meals tax of 075 three-quarters of one percent. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Harvard researchers estimate adding pennies to sugary drinks alone would raise 368 million annually in Massachusetts.

The tax is levied on the sales price of the meal. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. And junk food taxes have shown no negative impact.

The tax is collected along with. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications. The sale of food products for human consumption is.

While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Massachusetts local sales tax on meals.

Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. These businesses include restaurants cafes. Generally food products people commonly think of as.

This page describes the taxability of. In Massachusetts certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. A full 3 million of you are set to get a tax refund starting Nov.

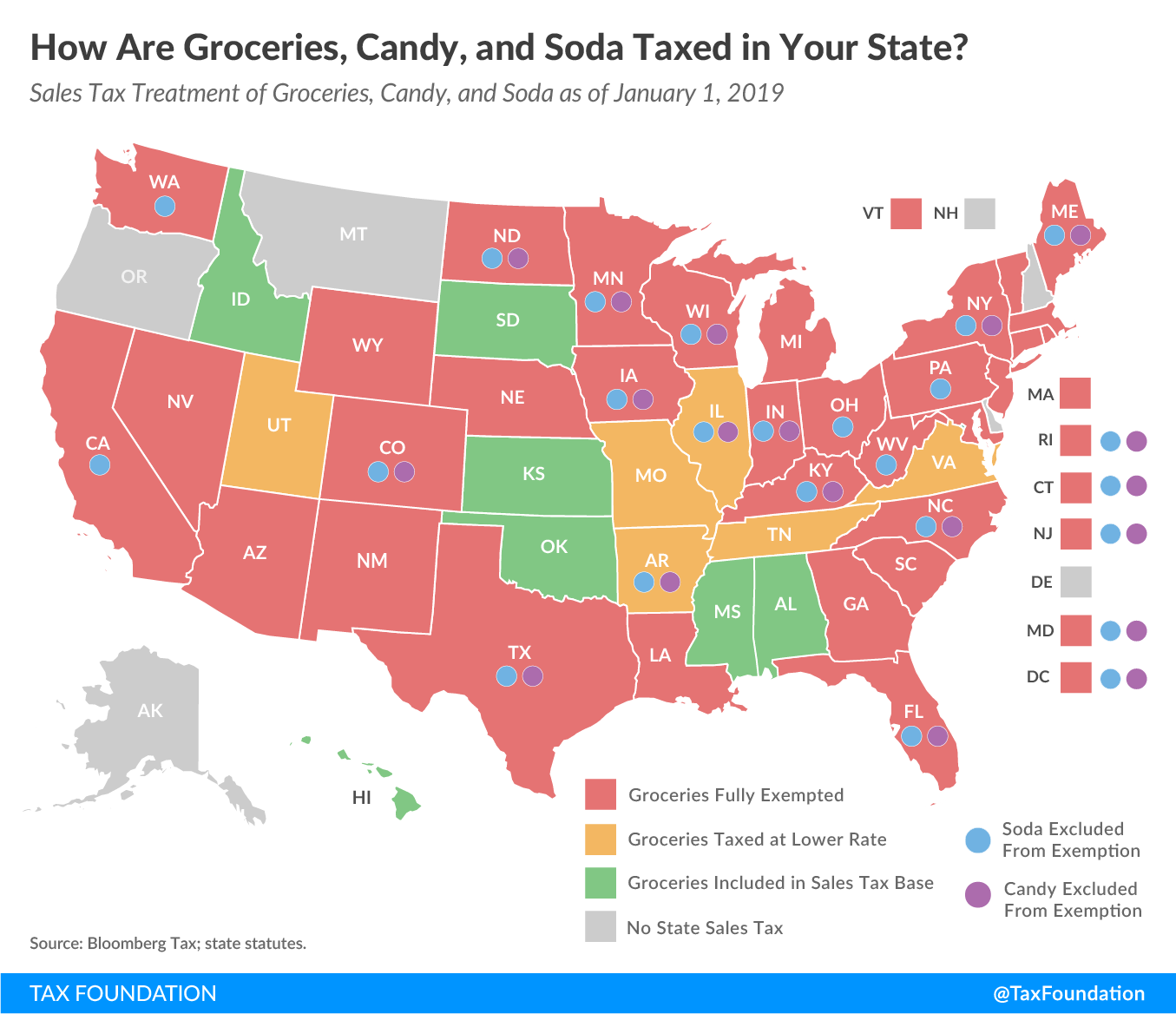

All winegrowers all farmer-brewers and all wholesalers of alcohol beverages licensed in Massachusetts must file Forms AB-1 AB-1F also known as Schedule F and AB 4. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do not levy taxes on. 625 state sales tax 1075 state excise tax up to 3 local option for cities and towns Monthly on or before the 20th day following the close of the tax period.

Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. What is the Maximum SNAP EBT Benefit for 2023. The state of Massachusetts is issuing checks.

The base state sales tax rate in Massachusetts is 625. Raising revenue from a junk food excise tax can create funds to reinvest. The Massachusetts sales tax is imposed on sales of meals by a restaurant.

More than 40 percent of all Massachusetts cities and towns now assess the 075 local tax on meals. Sales Tax Exemptions in Massachusetts. Food sold by a business that is primarily engaged in the business of selling meals is taxable at the Massachusetts meals tax rates.

The Massachusetts sales tax rate is 625 as of 2022 and no local sales tax is collected in addition to the MA state tax.

After Baker Pans Plan To Up Real Estate Transfer Tax Wu Digs In

Massachusetts 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Masstax Prepared Accounting Blog Accounting Insights Tips News

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Mass State Tax Holiday Won T Apply To Restaurants Wjar

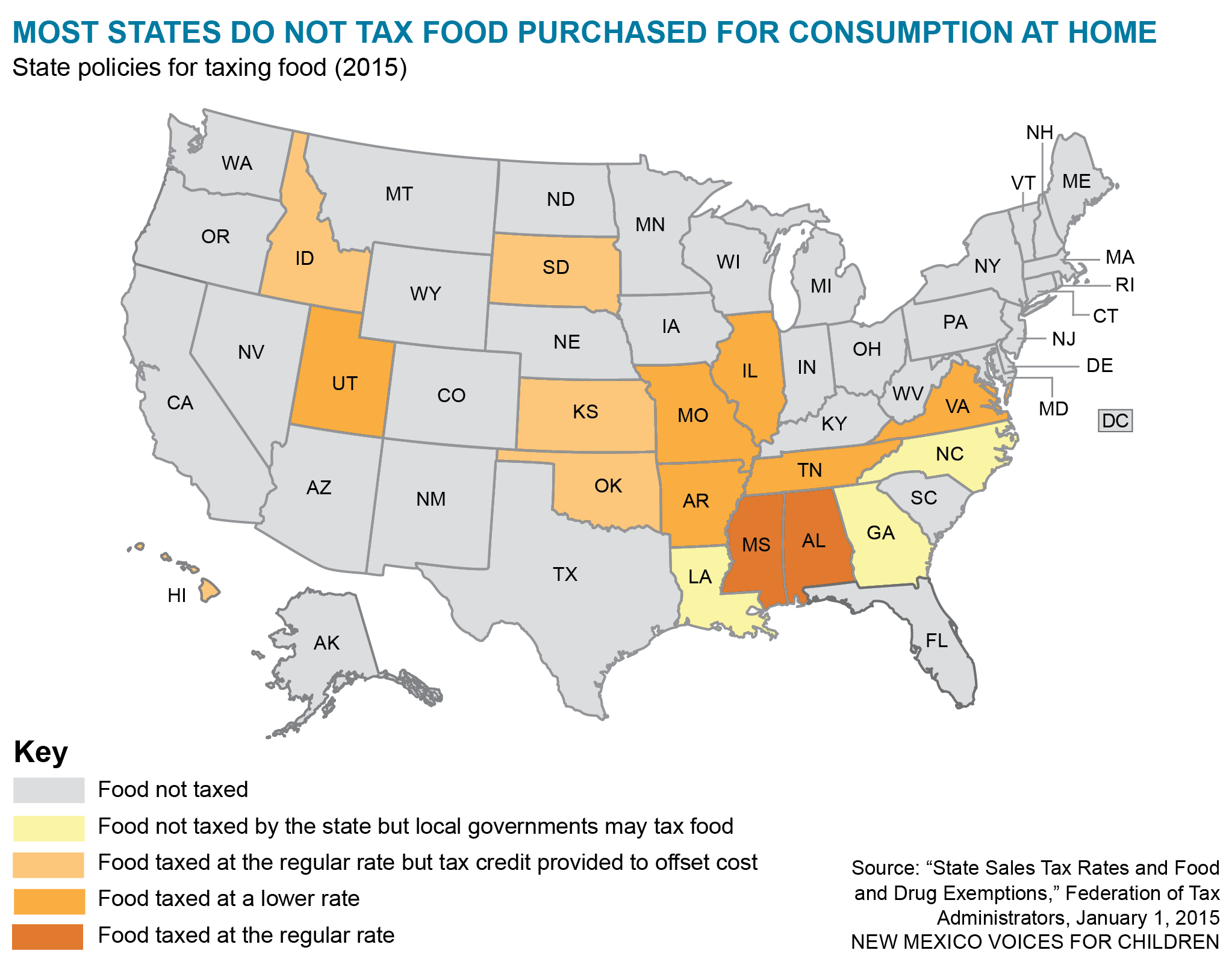

How Are Groceries Candy And Soda Taxed In Your State

Is Food Taxable In Massachusetts Taxjar

Hunger Food Insecurity In Massachusetts Project Bread

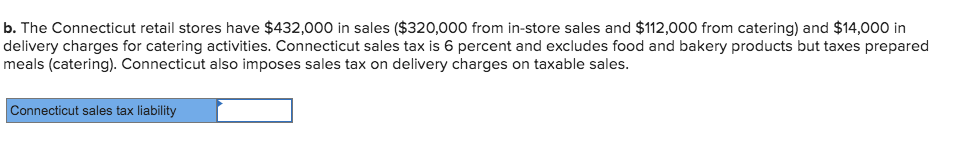

Solved Required Information The Following Information Chegg Com

Massachusetts Tries New Bite At Sales Tax Revenue By Focusing On Internet Cookies

State Legislators Discuss Raising Utah S Sales Tax On Food From 1 75 To Nearly 5 Kutv

Massachusetts Legislature Passes Bill To Provide Immediate Relief To Municipalities And Others During The Ongoing Covid 19 Crisis Senate President Karen E Spilka

1986 Massachusetts Tax Law Upends Economic Development Bill

Massachusetts Tax Rates Rankings Ma State Taxes Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

A Health Impact Assessment Of A Food Tax In New Mexico New Mexico Voices For Children

The Great Tax Debate Of 2009 Facts And Figures That Help News Events Massachusetts Nurses Association