child tax credit dates december 2020

Canada child benefit payment dates. Ad Receive the Child Tax Credit on your 2021 Return.

With Monthly Payments Stalled Congress Needs To Act Center On Budget And Policy Priorities

As at 2nd December 2020 there were approximately.

. Wait 10 working days from the payment date to contact us. However you do not have to make this payment if you file your 2019 return Form 1040 and pay any tax due by. Payment Dates for Weekly Payers.

New Jersey Office of Vital Statistics and Registration. Alphabetical Summary of Due Dates by Tax Type. It is a partially refundable tax credit if you had earned income of at.

1400 in March 2021. 1200 in April 2020. You were domiciled and maintained a primary residence as a homeowner or tenant in New Jersey.

Ad Get the most out of your income tax refund. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later. Here are some numbers to know before claiming the child tax credit or the credit for other dependents.

This is a fall of approximately. CCB Payment Dates for 2022. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children.

You are eligible for a property tax deduction or a property tax credit only if. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Chronological Listing of Filing Deadlines.

The payments will be made either by direct deposit or by paper check depending on what. 15 opt out by Aug. The maximum amount of the credit for.

This is the final installment date for 2019 estimated tax. Claim the full Child Tax Credit on the 2021 tax return. It is in addition to the credit for child and.

File Federal Taxes to the IRS Online 100 Free. 199m families claiming Child Tax Credit CTC andor Working Tax Credit WTC. October 5 2022 Havent received your payment.

Get Help maximize your income tax credit so you keep more of your hard earned money. All payment dates. Here are the official dates.

COVID-19 Stimulus Checks for Individuals. The form and above items are to be submitted to. For each qualifying child age 5 and younger up to 1800 half the total.

The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. Still Birth Certificate Processing. The maximum amount of the child tax credit per qualifying child.

The maximum child tax credit amount will decrease in 2022. January 1 2020 - December 31 2020. The CRA makes Canada child benefit CCB payments on the following dates.

The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

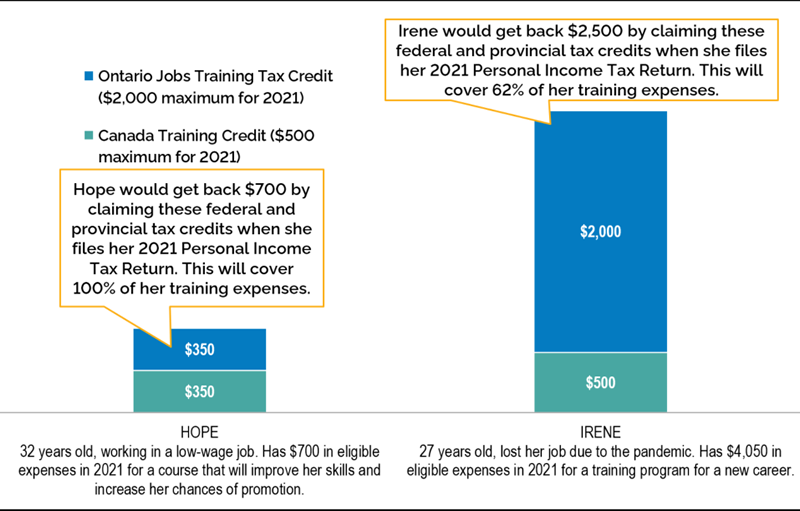

Ontario Jobs Training Tax Credit Ontario Ca

Parents Guide To The Child Tax Credit Nextadvisor With Time

Child Tax Credit Ending Will Push 10 Million Kids Back Into Poverty

Child Tax Credit Definition Taxedu Tax Foundation

Childctc The Child Tax Credit The White House

Family Tax Deductions What Can I Claim 2022 Turbotax Canada Tips

5 Things To Remember For Us Expats Things To Know Us Tax Infographic

Policy Basics The Child Tax Credit Center On Budget And Policy Priorities

What Is The Difference Between Refundable And Nonrefundable Credits Tax Policy Center

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Gauging The Impact Of The Expanded Child Tax Credit S Expiration

Child Tax Credit Definition Taxedu Tax Foundation

Can Poor Families Benefit From The Child Tax Credit Tax Policy Center

/cdn.vox-cdn.com/uploads/chorus_asset/file/23979823/bigbill.jpg)

Will Child Tax Credit Payments Continue In 2023 The Fight Is Not Over Vox

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Child Tax Credit Definition Taxedu Tax Foundation

Romney Child Tax Credit Proposal Is Step Forward But Falls Short Targets Low Income Families To Pay For It Center On Budget And Policy Priorities

Benefits Of Expanding Child Tax Credit Outweigh Small Employment Effects Center On Budget And Policy Priorities